| HOME | INDEX OF ARTICLES |

PortFolio Weekly

June 15, 2004

| HOME | INDEX OF ARTICLES |

PortFolio Weekly

June 15, 2004

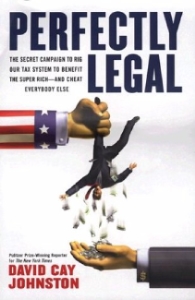

The most important book of this highly charged political year is Perfectly Legal, by Pulitzer Prize winning journalist David Cay Johnston. In this book, subtitled The Covert Campaign to Rig Our Tax System to Benefit the Super Rich---and Cheat Everybody Else, the author clearly and methodically makes the case that “our tax system now forces most Americans to subsidize the lifestyles of the very rich, who enjoy the benefits of our democracy without paying their fair share of the price.”

In a campaign season fraught with partisan diatribes and overhyped outpourings by high profile broadcast and political personalities, Perfectly Legal is a fact-packed, low-key expose that every thinking American needs to read. You may finish the book not knowing whether to be angry, depressed, overwhelmed or spurred to action, but you cannot ignore the book’s findings.

In a campaign season fraught with partisan diatribes and overhyped outpourings by high profile broadcast and political personalities, Perfectly Legal is a fact-packed, low-key expose that every thinking American needs to read. You may finish the book not knowing whether to be angry, depressed, overwhelmed or spurred to action, but you cannot ignore the book’s findings.

I spoke with David Cay Johnston by phone last month from his office at the New York Times, where his investigative reporting about the tax system over the last nine years has resulted in three Pulitzer nominations. When he won the prize in 2001, he was cited “for his penetrating and enterprising reporting that exposed loopholes and inequities in the U.S. tax code, which was instrumental in bringing about reforms.”

He notes in the book that “1972 marked the end of the economic glow that warmed the American economy after World War II” and that since that time, “most Americans have struggled and many have made ends meet only by becoming two-income households. But some people have prospered to a degree unprecedented in our nation’s history.”

I began our discussion by asking how this happened.

“We changed our tax policy in ways that fundamentally encourage huge disparities,” he replied. “You do not see the kind of disparities in income in the Western European countries, Canada and Japan that you see in the United States.

“We’ve also developed in the rules of our economy what other people have identified as a ‘winner take all’ syndrome. So that someone who is a tiny fraction of one percent distinguished from someone else---not necessarily better, just distinguished in some way---often ends up with pay which is vastly greater than someone almost their equal.

“It used to be that running a big company was a road to becoming prosperous and very comfortable,” he continued, “but not to become a player, independently wealthy. That has changed. Managers have begun taking money out of companies as if they were the owners of the companies. And that’s had an enormous consequence.”

He also believes the decline of union representation among the baby boom generation has had a huge impact on wages, benefits and tax policy:

“In the early ‘70s, about 37% of all workers belonged to a union. At that time, about 80% of all workers benefited from unions because there were employers who paid union wages to keep the unions out. There were employers who paid premium wages and were able therefore to get the premium workers. As the unions have lost power, wages have contracted and we have de facto a policy of lower wages in America. We are the only country in the world pursuing a lower wage strategy.

“One of the problems that the unions have had is that they were successful. They raised millions of people out of poverty into a pretty steady economic environment. A lot of people ignore the fact that the reason they have health insurance, the reason that they have paid holidays and can work 40 hours a week was the union. Now that it’s gone, many people fail to see the connection between those things.”

Prior to the massive tax cuts for the wealthy by the current Bush administration, the largest impact on the taxes of working Americans came in 1983, when the Social Security payroll tax shifted from a “pay as you go” system to one in which the government began collecting more than was necessary to meet current benefit payouts. At the time, the increase was called a “bail out” of the Social Security system, intended to insure that the system would still be solvent when the baby boomers began retiring thirty years later.

“Instead,” Johnson says in the book, “what happened was that the working poor and the middle class, indeed everyone making up to the maximum wage taxed for Social Security, paid more taxes than were needed to allow generous tax cuts for the rich.”

In our conversation, he said, “Congress could’ve chosen to spend that money on tax cuts for the middle class. The promise at the time was that, in fact, we were going to pay off the national debt. That was the official claim; we were going to pay off the national debt to increase our borrowing capacity. Now, if we had balanced the budget all these years, we would have paid off the national debt.”

But that’s not what happened. Furthermore, when George W. Bush campaigned for the presidency in 2000, he spoke of a Social Security “lockbox” to assure that “Congress won’t be using payroll taxes for other programs.” But, as Perfectly Legal points out, “Bush’s tax plan depended on raiding the Social Security lockbox.”

It is this redistribution of income UP the income ladder that David Cay Johnston wants taxpayers to understand. While politicians have railed about welfare queens and giveaways to the poor, recent tax policy has resulted in something entirely different.

“The most important thing I want to get across to Americans,” he said, “is that if you are in the middle class and the upper middle class, if you are in the $30,000 to about a million dollars in income, the government is literally taking money out of your pocket and funneling it to the super rich.

“The surplus Social Security tax is just spent. Every non-politicized economist who’s thought this through recognizes that to redeem the Social Security trust fund treasury notes is going to require higher income taxes on the best-off Americans somewhere in the future. There’s just no two ways around it.”

Johnston goes out of his way to be bipartisan, both in his book and when he’s talking. He is, in fact, a registered Republican. But he gets very passionate when talking about today’s so-called “conservatives.”

“These people are not conservative in the classical meaning. They are radical. There are tried and tested ideas with long histories---taxing based on the ability to pay. Certainly John Locke and Adam Smith hated taxes, but they understood that taxes should be based on the ability to pay. That’s clearly not the current concept.

“What are being promoted to us today by these faux-conservatives are radical, untested ideas. Once people begin to understand that these are radicals, I think they’ll begin to see this doesn’t comport with more than 2,000 years of what we’ve learned in western civilization. And it is undermining our country.”

He devotes chapters of Perfectly Legal to the ways the “donor class” have worked their political connections, used highly paid accountants and lawyers to avoid taxes, growing their wealth exponentially while the bottom 99% of Americans have stayed flat or lost ground over the last 30 years. He explains how the inheritance tax became the “death tax” in political parlance, and notes that IRS statistics on estate tax returns showed that “only 2% of the 2.4 million Americans who died in 2000 left an estate that owed any taxes.”

The book also addresses the problem of corporations moving their headquarters to offshore post office boxes to avoid taxes, the end of company-paid retirement benefits for most workers, and the handcuffing of IRS enforcement capability. A not-so-pretty human face is put on the gouging being perpetrated by those in the CEO/Board of Directors club. There are surprises as well as confirmations of things you may have thought but couldn’t quantify.

“There are two really big pieces of news in my book,” he told me. “One is that 28,000 people have as much income as the bottom 96 million. The second fundamental finding in the book is that, not only do we not have a progressive structure, it has a curve to it. It goes up and then it falls off, in terms of the percentage of your income that you pay the government; it peaks at about 1.5 million dollars of income, then it starts falling off. Beyond that, the fact that we literally are funneling money through the excess Social Security tax and the AMT to the super rich in the form of tax cuts. That is absolute brand new news.”

After absorbing all the detail accumulated in the book, I had to ask its author if he sees any hope for the future.

“I think that a few million Americans have to come to understand that without taxes, there is no America, and that we want to make the country endure. The real underlying motivation of why I wrote the book is that I don’t ever want there to be a high school civics textbook that starts off with a chapter that says, ‘The United States of America was…’

“I hate paying taxes as much as anybody, but I love America more. I recognize that I am unbelievably blessed to have been born in this country, to experience freedoms that were unimaginable to most of human history that have profoundly changed the world for the better.”

But it will take an informed populace to demand a more equitable tax system in which everyone pays their fair share. This book could be a primer for revolution in the American tax system.

“So long as the gut reaction of most Americans to the word ‘taxes’ is ‘don’t want to hear about it,’ and to vote out of office anyone who is posted as being a ‘tax raiser,’ we’re not going to get any reform, we’re going to wind up with nonsense. We can take back our tax system. But a lot of people have to decide that it’s worth a little bit of their time to read and understand, and they then need to be involved in the political process.”

copyright © 2004 Port Folio Weekly. Used by Permission.

| HOME | INDEX OF ARTICLES |